Golden Visa Programs

Greece first enacted the potential for the provision of residence permit to foreign investors in 2014 through the Immigration and Social Integration Code. Ever since, Greece continues to offer the most competitive Golden Visa program in the European Union, with three distinct investment zones based on property location and value. Additionally, in all three zones, the transfer of the purchase price can be completed through a proxy lawyer, providing greater flexibility and convenience for international investors.

General Scope

1. Modernization of the process bureaucracy elimination, short term procedure that requires a single visit of the investor to any area of the Greek territory.

2. Fast-track procedures.

3. Absence of involvement by the Competent Authorities regarding the investor’s country of origin. There is no certificate required and practically the Competent Authorities of the investor’s permanent residence shall never be informed regarding the granting of the relevant residence permit.

4. There are no minimum stay requirements. The investor may remain in the country for 0 up to 365 days.

5. Initial endorsement of five (5) years duration with the potential of renewal provided that the initial investment has been preserved.

6. The specified residence permit addresses to an extended family circle since in addition to the primary beneficiary-investor it is also granted to

the spouse and children under the age limit of 21 as well as to the direct relatives in the investor’s ascending line and the spouse’s correspondingly.

7. The duration regarding the possession of the residence permit admeasures the required time for the acquisition of the Greek citizenship. After seven consecutive years of actual residence in Greece, holders of the Golden Visa, along with their family members, may apply for Greek citizenship—provided they have resided in the country for at least six months per year, meet financial and integration criteria, and successfully pass the required Greek language examinations.

8. Provision of free access to Public Health and Public Education institutions.

9. Free movement within the Schengen zone for 90 days every 6 months.

Specifically, regarding the granting of residence permit via investment in real estate property (minimum investment of 250.000 EUR with conversion of industrial buildings or restoration of listed buildings)

Investment in a thriving market with large margins of profit. In 2023 foreign investments in the Greek property market have reached a total of 2,1 billion

euros. Ability of leasing the property by long term conventional lease agreement.

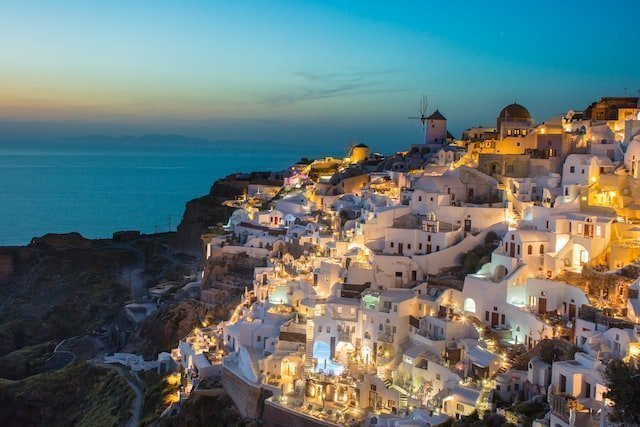

1. 800.000€ - ZONE A

The minimum investment requirements for real estate vary by location. For the Region of Attica, the Regional Units of Thessaloniki, Mykonos, and Santorini, and the islands with a population of more than 3,100 inhabitants, the minimum investment is 800,000 € for a property of at least 120 square

meters. More specifically, the islands with a population of more than 3,100 inhabitants, include the following:

- Crete

- Evia

- Rhodes

- Corfu

- Lesbos

- Chios

- Zakynthos

- Salamina

- Kos

- Kefalonia

- Samos

- Lefkada

- Syros

- Naxos

- Kalymnos

- Limnos

- Paros

- Thassos

- Aegina

- Tinos

- Ikaria

- Andros

- Leros

- Karpathos

- Skiathos

- Milos

- Skopelos

- Spetses

- Kythera

- Patmos

- Poros

- Alonissos

2. 400.000€ - ZONE B

For other areas in Greece, the minimum investment is 400,000 € for a property of at least 120 square meters.

3. 250.000€ - EXCEPTION FROM ZONE A & B

For conversion of industrial buildings into residential units the minimum threshold remains 250,000 €, regardless of the location and the size of the property, provided the industrial activity ceased at least five years prior to the investment. For the restoration of listed buildings, the minimum threshold remains 250,000 €, regardless of the location and the size of the property. While the 800,000 EUR and 400,000 EUR zones require a minimum property size of 120 square meters, the 250,000 EUR threshold remains the most accessible, as it does not impose any minimum square meter requirement.

Use Restrictions & Compliance Requirements:

- Minimum property size requirement of 120 square meters.

- No Short-Term Rentals: Properties purchased under the Golden Visa cannot be rented out short-term through platforms like Airbnb (including sublease agreements).

- Company Registered Seat Restrictions: Properties converted from commercial to residential use cannot be used as a company’s registered seat. Non-compliance will lead to revocation of the residence permit and a 50,000 EUR fine. Amendments to the Greek Golden Visa Program enhance its appeal to international investors by streamlining the process, updating investment thresholds, and introducing clearer regulations on property usage. The program remains one of the most accessible and attractive residence-by- investment options in Europe, with minimal bureaucracy, low investment requirements, and a clear pathway to Greek citizenship after seven years.

Specifically, regarding the granting of residence permit for investment in Greek Startup (article 100A, L.5038/2023)

Starting from January 1, 2025, residence permits will be granted to third-country nationals who invest at least €250,000 in a Greek startup that is a member of the National Registry of Startups (Elevate Greece). The following cumulative conditions must be met:

- Shareholding Limit: The acquired shares, stakes, or participation should not exceed 33% of the company's capital or voting rights.

- Job Creation: The company must create at least two new jobs within the first year of the investment.

- Job Retention: The company must maintain at least the same total number of jobs, including the new jobs, for at least five years following the investment.

- The investment must be made with funds transferred from abroad to Greece specifically for the investment purpose. The remittance can come from the investor's spouse, civil union partner, or blood relatives up to the second degree.

The residence permit will initially be granted for one year. It can be renewed for two years at a time, as long as the investment is maintained and the other

conditions are met.

If the business is removed from the Elevate Greece registry, the permit can still be renewed, provided all other conditions are satisfied. Absences from Greece do not prevent the renewal of the residence permit. The residence permit does not grant the right to access any form of employment within the country beyond the scope of the specific investment. The Directorate of Residence Permits at the Ministry of Migration and Asylum is responsible for reviewing applications, based on recommendations from the relevant services of the Ministry of Development.

Specifically, regarding the granting of residence permit via Investment in Bank Deposits (article 99, L.5038/2023)

The minimum amount of a term deposit is 500,000 euros.

1. Provision of currency and banking system stability which is comprised of the operation of merely four systemic bank institutions with complete restructuring. This also includes contemporary banking products with high-performance ability.

2. A term deposit of at least €500,000 in a domestic financial institution, with a minimum duration of one year and a standing renewal order,

may qualify for the residence permit. The investment and its retention are certified by certificates issued by the financial institution.

3. Contemporary banking products with high performance ability.

4. Extremely low investment amount in relation with the rest of European investment programs.

5. There are no minimum stay requirements.

6. Fast-track procedures within two (2) months.

7. Initial endorsement of five (5) years duration.

8. The Golden Visa can be renewed every five (5) years provided that the

holder maintains the initial investment in Greece.

9. A large group of people are eligible with only one investment, which includes husbands and wives, children and parents of both spouses.

10. This allows access to public health and education.

11. Zero operating investment costs since there is no involvement of notaries, real estate agents, accountants, capital taxation etc. Simple and fast exit strategy by just transferring the funds to another jurisdiction.